The Wonders of Compound Interest

Understanding how compound interest works and acting on that knowledge can be a financial game-changer which improves your wealth trajectory for the rest of your life.

There are no real magical formulas for growing wealth – with the possible exception of compound interest.

No less a person than Warren Buffett, arguably the most famous investor the world has seen, is an advocate of buying good-quality assets for the long term and then letting compound interest do its thing.

So, what is compound interest? You’ll find many definitions, but in short it involves reinvesting the interest you earn on a balance in a bank account or an investment, which in turn earns you more interest. Put another way, money makes money – and the money that this money makes, makes money.

If you manage your finances wisely, compound interest can accelerate the growth of your savings and investments over time and put you in a stronger wealth position.

Simple maths

When calculating interest, there are two basic choices: simple and compound. With simple interest, you earn a set percentage of the principal amount of your investment.

For example, if you invest $1000 at 5 per cent with simple interest for 10 years, you will receive $50 in interest each year for the next decade. Nothing more. However, with compound interest, you earn interest on the interest. In this case, if you invest $1000 at 5 per cent interest you’ll get a $50 interest payment after the first year. If you reinvest it, in the second year your interest is calculated on a $1050 investment, which adds up to $52.50. And on it goes, with the principal and the interest growing each year.

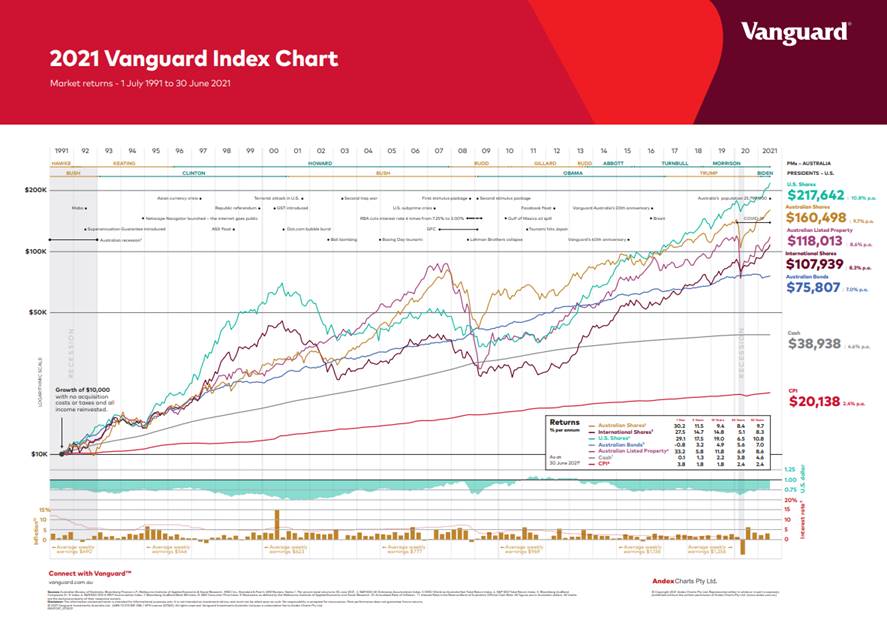

The impact on a long-term investment can be enormous. Check out the example (Graphic 1) which compares the difference between putting $10,000 into simple-interest bonds over 30 years and generating $38,000, versus investing $1000 into shares and generating $216,000 over the same period thanks in large part to compound interest. A combination of quality assets and compound interest can have a stunning financial effect.

This is where it pays to receive advice from a wealth management expert to explain your options and maximise your investment.

Patience, patience, patience

Benefiting from compound interest requires a change of mindset. You’re effectively delaying gratification from your money – instead of buying that new car or going on an expensive holiday right now, you’re putting your money away for your long-term future.

We’ve seen some low-wage workers accumulate far more wealth than some corporate professionals earning $500,000 a year because the former saved their money and reinvested it, while the latter kept increasing their spending as their salary rose.

In essence, the magic of compound interest calls on you to make a sacrifice now on the promise of having a better and more financially comfortable life later. This takes discipline and patience and an understanding that some of the assets in which you invest could be volatile over the short-term. Hold your nerve.

The keys to success

To really benefit from compound interest, give yourself time. The sooner you start saving and investing, the longer you have for that money to grow. While making an investment at age 25 compared with 35 may seem insignificant, it can result in a significantly better financial outcome over time (Graphic 2). With your money working harder and harder for you each year, you will reap the gains in the future and the bulk of your retirement funds can be accumulated through compounding.

The other imperative is to pay down debt aggressively. Just as compound interest can work for you when you invest, it can work against you when you borrow money, whether that’s via loans, credit cards or other forms of borrowing. If you’ve ever wondered why paying off credit card debt seems so hard, compound interest is one of the answers.

So, don’t ignore the power of compound interest – and don’t delay. With the assistance of an experienced financial advisor, it can make a world of difference to your financial future.

Disclaimer:

The above information is general in nature, it is not meant to be relied on in making financial decisions. Please note, past performance is not a reliable indicator of future performance. The article was written by David van den Berg an authorised representative (AR number 263500) of Adrians Wealth Management Pty Ltd AFSL 522841.

No representation is given, warranty made or responsibility taken about the accuracy, timeliness or completeness of information sourced from third parties. Because of this, we recommend you consider, with or without the assistance of a financial adviser, whether the information is appropriate in light of your particular needs and circumstances.