Tips to shave years off your mortgage

A home loan is the biggest financial deal that most people will strike during their lives, but they often just accept the terms their bank offers and set and forget the mortgage. That can be a costly error. Here are five ways to pay off your loan faster.

- Negotiate a lower interest rate

Rising interest rates and living costs are top of mind for most households right now. Remember, however, that you don’t just have to accept the banks’ rates. The banking and home loans space has never been more competitive, so check to see if your rate is competitive with similar loans and, if it’s not, contact your bank and request a better offer.

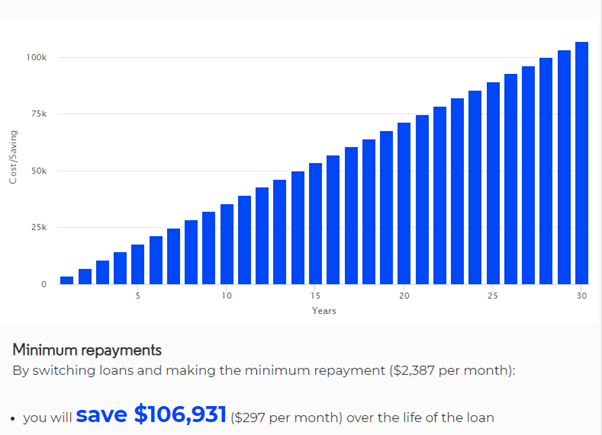

A 1 per cent rate reduction can make a huge difference in repayments over the course of a 30-year loan. Based on a $500,000 loan reducing your interest by 1%, it may be possible to save over $106,000 in interest over the life of the loan (see chart below).

Provided you have a good credit rating and the ability to meet repayments, banks will almost certainly want to keep your business. If you don’t ask, they are unlikely to do you any favours.

In a scenario where your current bank won’t budge on the interest rate, it is easier these days to switch mortgages to a different financial institution offering a better rate. This move could result in some annoying paperwork, though.

Please note: The above is based on a $500,000 loan with a 30 year term at 5% interest with zero fees compared to the same loan at an interest rate of 4%. Calculation completed https://moneysmart.gov.au/home-loans/mortgage-switching-calculator

- Get smarter on how you pay down your debt

Many people have multiple debts, including an investment loan, a home loan, and some consumer debts. What they typically do is pay off the investment loan first, rather than their home loan.

Why is that a mistake? Well, an investment loan that has been taken out to buy something that creates income (such as a rental property) is tax deductible. A home loan is not. So, you really want to concentrate on paying off your non-deductible loan first.

- Consider consolidating your debts

Home loans with current interest rates in the 3 per cent to 4 per cent range will usually be your cheapest source of funding. Car or personal loans for holidays, by comparison, will typically come with an interest rate of about 10 per cent, while credit cards are upwards of 20 per cent.

As a result, most financial advisers will advise you to pay down your credit cards and personal loans first, and to then tackle your home loan. Of course, some people may not have the cash-flow to do so, in which case you can discuss with your bank the possibility of consolidating high-interest debts into your mortgage.

Think about it – a credit card $20,000 with a high interest rate will cost you thousands of dollars a year, whereas the same amount in a home loan will only cost you hundreds of dollars at current rates. Over a number of years, that difference can really add up.

- Make additional repayments

Of course, adding debt to your home loan will increase the time it takes to pay off your mortgage – unless you make extra repayments.

This all comes down to your cash flow. Now is the perfect time to review budgets and cash flow to see if you can free up some money to pay off debt commitments. A tax return or a work bonus could also be pumped into your mortgage, for example. Every bit helps.

Another popular way to make extra repayments is to switch to fortnightly mortgage payments. By making 26 fortnightly repayments rather than 12 monthly payments, you’re essentially making an extra monthly payment off your loan a year. This shortens the life of the loan and cuts the amount you need to pay.

- Consider an offset account

An offset account is a savings or transaction account linked to your mortgage. Any surplus savings that aren’t being used can sit in the offset account and this reduces your debt and the interest you pay on the loan. In turn, this helps you pay off our loan faster.

Some people opt for a redraw facility whereby they put all their mortgage payments into their home loan, but this can be risky as many people redraw more money than they put in. This means they can actually go backwards.

Finally, it is worth making the point that people who fall into financial strife and are struggling to pay off their mortgage should talk to their bank. Most banks are open to negotiations if their customers are in distress and they may be able to put payments on hold, or consider hardship provisions.

However, act sooner rather than later. Putting your head in the sand if finances are tough will only make things worse.

Seeking advice to pay off your mortgage faster can dramatically change your financial outlook. So, click here to find out more and get in touch with one of Australia’s leading wealth-management firms.

The above information is general in nature, it is not meant to be relied on in making financial decisions. The article was written by David van den Berg an authorised representative (AR number 263500) of Adrians Wealth Management Pty Ltd AFSL 522841. It is recommended you speak with your Financial Adviser, Financial institution and/or Mortgage broker before you make any changes to your loan facility.

No representation is given, warranty made or responsibility taken about the accuracy, timeliness or completeness of information sourced from third parties. Because of this, we recommend you consider, with or without the assistance of a financial adviser, whether the information is appropriate in light of your particular needs and circumstances.