Using Superannuation to Minimise Tax and Build Wealth

As well as assisting people to save for retirement, superannuation offers a range of proven ways to reduce taxation.

There’s a misconception that superannuation is all about ‘money for the future’ and something that we can potentially ignore until the approach of retirement.

The truth is that super is a really smart tool to cut your tax payments now, while also being a recognised financial instrument to build long-term wealth. Unfortunately, many individuals and businesses are not aware of the tax benefits they may be able to claim through superannuation.

A simple example is that many small business owners do not realise that upon selling their business that they can potentially roll some of the proceeds into their super in return for tax advantages. Such a move can result in savings of thousands or even hundreds of thousands of dollars.

With that in mind, here is a guide to some common super-related tax benefits (please note there are may be additional conditions that need to be met).

- Concessional contributions – these include your employer Super Guarantee, salary sacrificing and personal payments into super (up to a cap of $27,500 per financial year). The tax rate for such pre-tax contributions is capped at 15%, which is clearly much lower than the highest marginal tax rate of 47% for high-income earners.

- Non-concessional contributions – these after-tax contributions (up to a cap of $110,000 per financial year) are a great way to save for retirement because they do not incur any tax upon entering your super fund.

- Co-contributions – if you earn less than $41,112 a year, the Australian Government will put in 50 cents for every dollar you put into superannuation up to a maximum of $500. This is a potential 50% return on your capital. If you did this every year over 20 years or so, that yearly benefit could really add up.

- Spouse contributions – if you and your partner meet certain conditions, you may be eligible for a tax offset for after-tax contributions into your spouse’s super account of up to $3000. The maximum tax offset is $540.

- Tax-free withdrawals – after you turn 60, any money you take out of your super, either as a pension or a lump sum, is usually tax free.

- Carry-forward contributions – also known as catchup contributions, they allow super fund members to use any of their previously unused concessional contributions cap. If you don’t use the full amount of your cap, you may be able to carry forward the unused amount and minimise your taxes.

Focus on building your wealth

Clearly, the less tax you pay to the Tax Office, the more money that stays in your super fund for potential long-term wealth accumulation.

One of the reasons for that growth is the magic of compound interest, which in effect involves reinvesting the interest you earn on a balance in a super account, and which in turn earns you more interest.

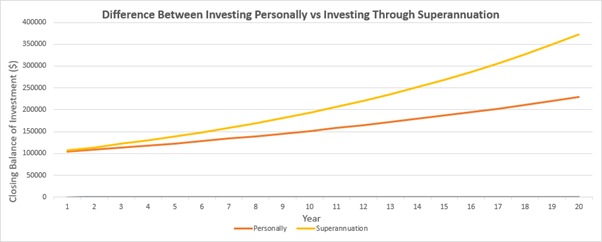

Consider this graph, which compares a personal investment of $100,000 taxed at the top marginal rate of 47% with the same amount in super taxed at 15% (the superannuation tax rate). The example assumes a return of 8% a year over a 20-year term – with the final difference being $143,306.

This is just one example, but it highlights the value of a smart super strategy. The sooner you start compounding returns, the more impact it will have on your finances in retirement.

Of course, tax is a complex area, so you should discuss your personal wealth ambitions with your accountant or a specialist wealth adviser to get the best possible returns through your super.

If you have largely dismissed the tax benefits of super in the past, it’s time for a change of mindset. Think of it as being a great way to plan for your future – while receiving tax benefits at the same time.